Are you struggling with Personal Financial management issues?

Do you know what is your net worth?

Are you aware of where is your money-flowing?

Are you spending too much and saving too little?

Do not know how much percentage of your wealth should go to investments, savings, and other expenses?

Do not worry, Lifectionery has come up with a unique platform that will help you meet all the requirements of necessities of a Personal Wealth Management Tool.

Wealth Management has been referred to as the most critical step towards analysis and achieving financial freedom. Before we begin the topic, let us first refer to some

great quotes by Warren Buffet on financial management-

1. On Earning:

"Never depend on a single income. Make investment to create a second source."

2. On Spending:

"If you buy things that you do not need, soon you will have to sell things you need."

3. On Savings:

"Do not save what is left after spending, but spend what is left after saving."

4. On Investment:

"Do not put all eggs in one basket."

I. Financial management

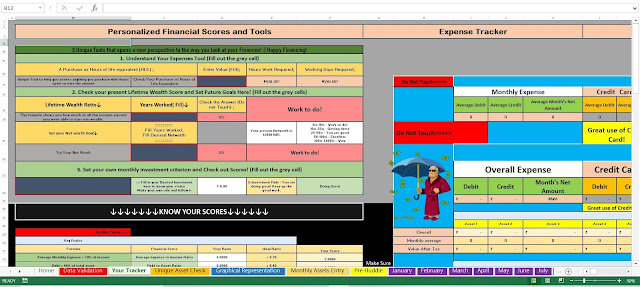

Financial management had never been this easy, personalized, and high privacy enabled. Personal Financial Management is the all-in-one tool for financial management, six different analyses, and financial knowledge.

“A budget is telling your money where to go instead of wondering where it went.” - Dave Ramsey

Focused on the higher vision of financial freedom - Individuals, Entrepreneurs, Job personnel, and anyone, anywhere, anytime - who wishes to manage their finances effectively can use & customize graphical representations and gain financial knowledge directly by analyzing their finances.

In this fast-moving era, lack of time and higher efforts are inversely proportional to success. Since available solutions in the market are very costly and do not guarantee privacy, Lifectionery has developed this user-friendly tool.

The Wealth Management Tool is an apt solution to all your management problems.

From analyzing your finances monthly to managing them yearly - this tool will help you realize the loopholes in your financial calculations and help you work way out accordingly!

This tool starts interpreting your data to the All-in-One Tracker as soon as you start using it the very first time.

It will enable you to -

1. Describe or Summarize a Set of Data to Monthly, and Yearly Columns - Descriptive Analysis

2. Examine or explore financial data and find relations between different variables. - Exploratory Analysis

3. Use a small sample of Financial data to understand your long-term finances - Inferential Analysis

4. Use historical or current Financial data to find patterns making future predictions - Predictive Analysis

5. Looks at the cause and effect of relationships between different financial variables, focused on finding the correlation - Causal Analysis

6. Understand exact changes in variables that will lead to changes in other variables - Mechanistic Analysis

It's easier ever to manage and track your finances monthly with greater privacy!

II. Features

The Wealth Management Tool is an apt solution to all your management problems. This tool is essentially built-in MS Excel, where

1. You reserve all the rights.

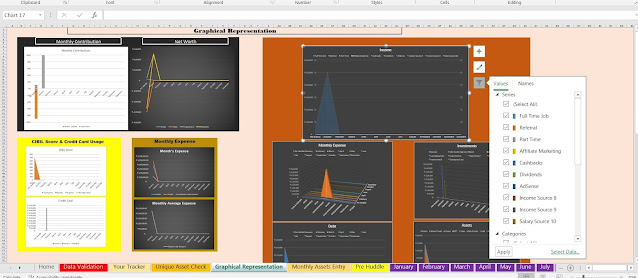

2. Personalize pivot tables and charts to track your finances.

3. Score-based financial evaluation metrics.

4. Unique in-built tools to help look at your finances all in a different perspective

a. Understand your expenses in terms of hours of life equivalent.

b. Check your Lifetime wealth Score. The formula shows how much of all your income earned turned into wealth

c. Set your net worth goals in user-defined years based on your current wealth management

d. Set your monthly investment criterion and understand if you have met your pre-defined ratio

5. Check your inflation-adjusted returns

6. Minimum Salary Range based on your expenses

7. Emergency Fund Analysis

8. Your Salary per hour

9. Personalized Burn Rate

10. Real Hourly Rate and comparison

11. Are you a Money Magnet?

12. The money you need to invest with an average interest rate of close to 5% to build enough savings for your retirements

13. Your Net Worth before and after Tax Deduction

14. Average and Total Monthly Expense and Credit at the end of the Year

15. Your Assets value before and after-tax deduction

16. Learning Area where you can understand Financial Management

And so many more added benefits to help you manage finances...

III. Get the Tool Now

Get lifetime access to Wealth Management Tool today!

You get unlimited live support access in this starter deal.

Get the tool right away on

Kindly find the attached screenshots for the Wealth Management Tool.

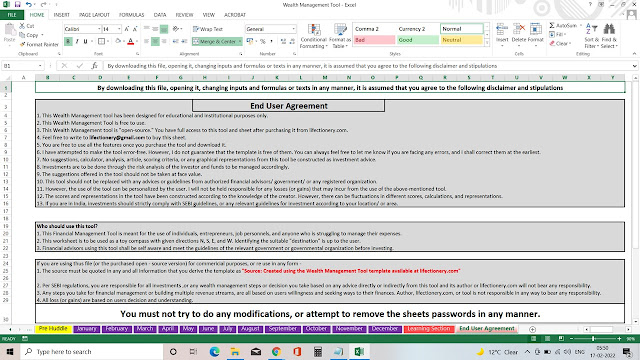

And, find the End-User Agreement here -

Feel free to reach out for any queries and demonstrations on the tool through email lifectionery@gmail.com

Wish you a Happy Financing,

No comments:

Post a Comment

We would like to hear from you about this post: